Banking and financial institutions

Create an invisible filter that repels malicious people without hindering real customers' access to your services. From document reading to authentication via mobile and internet, Fast Check ID blends harmoniously with your reception process, providing peace of mind and a first-class user experience.

Give your customers reliable service while meeting regulatory goals. Fast Check ID's cutting-edge artificial intelligence algorithms immediately recognize the type of document, examine its characteristics, and highlight any potential inconsistencies.

Software that can identify false documents can provide numerous benefits to the banking and financial industry by improving security, efficiency and compliance. Here are some ways in which it can be useful.

Fraud Prevention

This is perhaps the most immediate benefit. Banks and financial institutions are often targets of fraud attempts, where malicious actors use forged documents to open accounts, obtain loans, or engage in other illicit activities. Software that detects false documents can stop these fraudulent activities before they cause economic or reputational damage.

Regulatory compliance

Financial institutions must adhere to strict know-your-customer (KYC) and anti-money laundering (AML) regulations. Software that identifies false documents helps ensure that only legitimate customers are accepted, facilitating compliance with local and international regulations and reducing the risk of penalties.

Improved operational efficiency

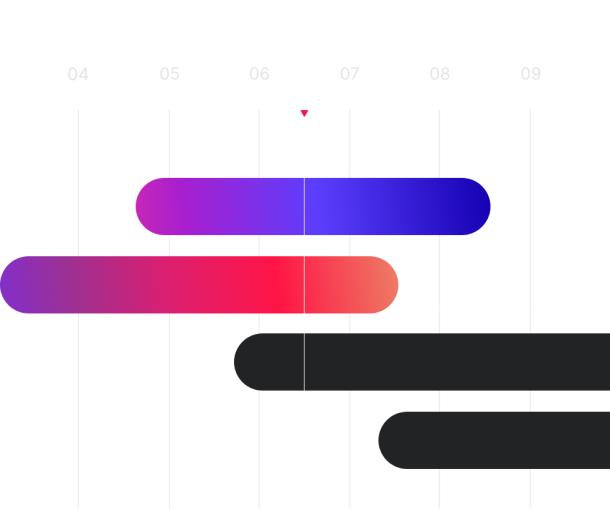

Manual document verification is a time- and resource-consuming process. By implementing automated software to identify false documents, banks can reduce staff workload, speed up customer onboarding processes, and improve operational efficiency.

Strengthening customer confidence

Security is a primary concern for customers of financial institutions. By demonstrating a commitment to combating fraud and protecting the integrity of customer accounts, banks can strengthen customer trust and loyalty.

Reduction of credit and operational risks

By using software to identify fake documents, financial institutions can reduce the risks associated with providing credit to fraudulent or unqualified parties, as well as minimize the operational risks associated with managing accounts opened with inauthentic documents.

Internationalization and scalability

With global expansion, banks need to be able to verify identity documents from multiple jurisdictions. Advanced software can recognize and analyze documents from many countries, thus supporting international expansion and scalability of operations.

Respect for privacy and data security

By implementing technology solutions that respect privacy and comply with regulations such as GDPR, banks can protect sensitive customer data, reducing the risk of data breaches that can have legal and financial consequences.