Customer Onboarding

Minimizes time and effort for an efficient customer onboarding process. In industries subject to regulations, such as finance, onboarding new customers is a daunting task because personal data is required immediately. This can increase the risk of losing customers if the process is too onerous. Regula steps in to make it easier for companies to comply with regulations by offering customers a smooth and unhindered onboarding process.

How FCI accelerates onboarding processes

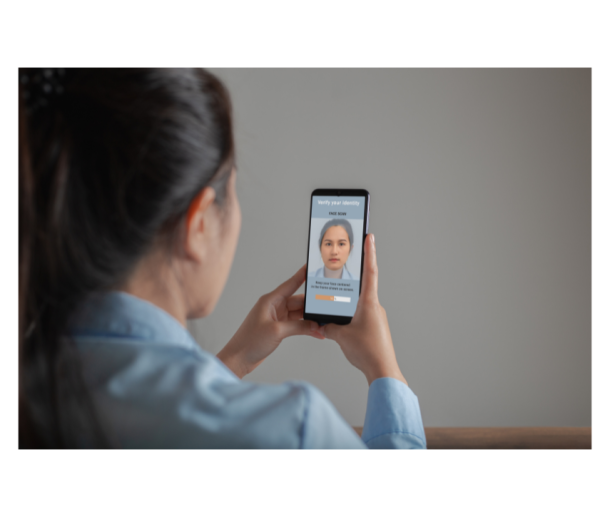

Increased adoption and activation rates

Boost adoption and activation rates by improving your customers' onboarding experience through the use of advanced document verification and biometric authentication solutions offered by Fast Check ID. This approach allows customers to complete the onboarding process quickly and easily, from anywhere and on any device, reducing the effort required and incentivizing more activations.

Increased accuracy

Ensures a higher level of accuracy in entering identification data by taking advantage of Fast Check ID's advanced OCR technology. This system automatically identifies the type of document and its specifications, thereby minimizing typing errors and ensuring the accuracy of customers' personal data.

Quick identity verification

Identification takes place in less than an instant, streamlining processes. Automate the collection of identification data by simply photographing a document with Fast Check ID, which immediately extracts and fills in the required fields, easing your team's manual work.

Survey of facial biometric features

Safeguard your business by implementing advanced document and biometric verification systems. Fast Check ID cross-checks submitted documents against an extensive database of templates, performing facial analysis to identify discrepancies in data, which can include visual areas, the machine readable zone (MRZ), RFID chips, barcodes and holograms, effectively contributing to fraud prevention.